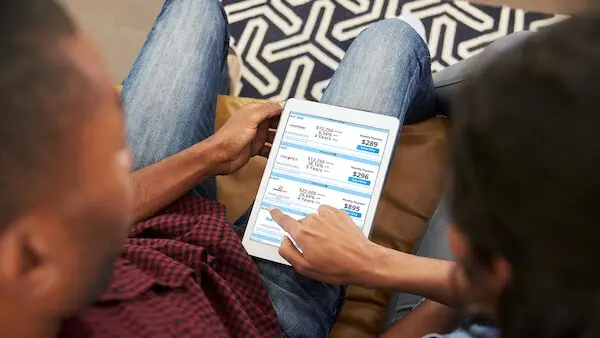

Secure Online Financing And Rent To Own Options For Metal Carports And Buildings

Compare Payment Options

Won’t Affect Credit Score

Not currently available in MA, NV, and RI.

BUY NOW,

Pay Monthly!

At Acorn Finance — An Open Marketplace With Top

National Lenders — You’ll Have All The Help You Need For Financing Your Needs And Wants.

RTO NATIONAL

Financing

RTO NATIONAL

Rent-To-Own

- Up to $20,000 approvals

- No Proof Of Income Required

- No Driver's License Required

- Pay Off The Principle Balance At Any Point - No Penalty

- Rates Start At 12.95%

- No Application For Rent-To-Own

- Never A Credit Check - On Any Amount

- No Proof Of Income Required

- No Driver's License Required

- All Landowners Approved Up To $20,000

- Discounted Early Payoff

- RTO Not Available WI, MN, & NJ

DON'T LISTEN TO US, LISTEN TO THEM

Rate 4.7 / 5 based on 334 reviews. Showing our favorite reviews.

LET THE BEST LOAN OFFER FIND YOU

Whether for a home improvement project or other dream purchase, we take the pain points out of financing by letting you easily compare offers from our network of top lenders, with no impact to your credit score.

Typical home improvement projects that we help our customers finance include roofing, patios and decks, solar, kitchen remodels, HVAC, pole buildings and pole barns, painting, landscaping, sheds and ADUs, basements, driveways, and pools.

You can also use our platform to compare pre-qualified loan offers for other purposes including debt consolidation, medical expenses, auto expenses, and other kinds of major costs. And remember—you can check for offers without impacting your credit score!

100% online, 100% easy, 100% safe. That is Acorn in a, excuse the pun, nutshell.

GOT QUESTIONS? WE GOT ANSWERS!

Short answer: We are magicians who help your home improvements dreams come true. Long answer: Acorn Finance is a lending marketplace where the nation’s premier online consumer lenders pre-qualify customers for personalised loan options in 60 seconds, with no impact to the homeowner’s credit score. Acorn Finance uses an initial soft credit inquiry to provide access to competitive, fixed-rate loans through a fast and easy online process.

Dreams don’t come with a cap, but Acorn Finance’s network of lenders extends loans from $1,000 up to $100,000 for qualified customers. Except in California and Texas where the minimum amount is $2,000.

From roof to flooring, and everything in between! Funds can be used to purchase and install virtually any home improvement expense.

Applicants with excellent credit may be rewarded with rates as low as 6.24% and extended repayment terms of up to 144 months (12 years). We call it finance karma!

It’s faster than you think. Qualified applicants can be approved during business hours and may receive their funds within one business day.

Acorn Finance’s network of partners charge no penalties for early repayment. For personal loans and credit lines, some partners do charge origination fees of 1-8% on loans up to $50,000. For home equity loan and home equity investment products, partners typically charge origination fees and/or other closing costs. No fee options are clearly highlighted on the Acorn offers page.

Absolutely! Some of our funding partners accept such applications so co-borrowers are encouraged to apply. A co-borrower can be added to your Acorn form immediately after the primary applicant submits their information.

Almost all. Any internet-connected smartphone, tablet and personal computers across United States can access Acorn Finance, except MA, NV, and RI. We’re rapidly expanding to the remaining places, so please check the status of our current coverage map at www.acornfinance.com/acorn-finance-coverage to determine if we are serving your state.

Zero. Zilch. Nothing. It’s absolutely free.

Our real reward is to make your home dreams a reality. That’s why we don’t charge a penny to homeowners and contractors. But we do receive a small commission from the lenders.

Good question. The rates and terms offered on Acorn Finance are provided to us directly by the lenders. Which means they’re already making you their best offer and it won’t be different if you ask them in person. Additionally, you receive multiple offers from multiple lenders, in a few seconds, with just a few clicks, with no impact to your credit score. All under one roof! This way, you don’t just save on interest rates. You save on time, too.

Let us know when you know the answer to this one.